What Are Tax Credits and Tax Deductions?

• Both tax credits and tax deductions lower the amount of income tax you pay.

• Credits reduce your bottom-line tax bill dollar for dollar.

• Deductions reduce the amount of income used to calculate your tax burden.

When you’re looking for ways to lower your income tax burden, tax credits and tax deductions are your best friends. But they shouldn’t be confused—a $500 tax credit and a $500 tax deduction are very different things. And understanding the difference is key to estimating how much you’ll owe in taxes this year.

Tax credits directly reduce your tax bill. A $500 tax credit means you owe $500 less in taxes.

By contrast, tax deductions reduce your taxable income. A $500 tax deduction lowers your taxable income by $500, which could indirectly lower your tax burden, depending on the situation.

Both deductions and credits are designed by lawmakers to reward certain behaviors by taxpayers—or nudge them to take certain actions.

How Tax Credits Work

Tax credits are always more valuable than deductions because they cut your bottom-line tax bill dollar for dollar. The government offers them as a way to simplify tax filing for certain taxpayers, for example by offsetting expenses for parents with dependent children, or by providing a break for families with low or moderate incomes.

They may be refundable or nonrefundable; most fall into the second category. Nonrefundable tax credits can reduce your tax liability all the way down to zero. If a refundable tax credit is larger than what you owe in taxes, you will receive the difference in a refund.

Suppose you have a tax liability of $900 and a $1,200 tax credit. If the credit is nonrefundable, your tax burden would be zero. If the credit is refundable, your tax burden would be zero and you would receive a $300 refund.

Common Tax Credits

The Earned Income Tax Credit offers people with low-to-moderate income a way to pay less in taxes. To qualify, your earnings from a job or from self-employment must be within certain limits set annually by the government.

In 2020, earned income and adjusted gross income (AGI) must fall below $15,820 for single filers with no qualifying children, or below $56,844 for those married filing jointly with three or more children. The maximum amount of credit you can claim also increases with each of your first three qualifying children. In 2020, the maximum ranges from $538 if you have no qualifying children to $6,660 if you have three or more.

The Earned Income Tax Credit is fully refundable.

The Child Tax Credit offers families a tax benefit to offset the costs of raising children. The credit is $2,000 per child and is refundable up to $1,400 per child.

To qualify for the credit, you must have dependent children under age 17 who live with you for at least half the year. Families must also have earned income of at least $2,500. The credit phases out when a household reaches a certain level of modified adjusted gross income (MAGI). In 2020, the credit phases out at $200,000 of MAGI for single filers and at $400,000 for married joint filers.

The American Opportunity Tax Credit offers college students and their parents a benefit that offsets the cost of the first four years of higher education. To be eligible, the student must be enrolled at least half-time and pursuing a degree, certificate, or educational credential during the years they receive the credit, among other requirements.

The credit is equal to the first $2,000 you pay in qualified expenses for each eligible student, plus 25% of the next $2,000, up to a maximum credit of $2,500 per eligible student. Families with a MAGI of over $80,000 for taxpayers filing singly or $160,000 for those filing jointly receive a reduced credit. Singe filers with a MAGI over $90,000, or $180,000 for those filing jointly, cannot claim the credit at all.

The credit is 40% refundable, up to $1,000 per eligible student.

How Tax Deductions Work

Tax deductions allow you to subtract expenses in certain categories from your income, lowering the amount of money on which you calculate your tax payment. A variety of expenses qualify for itemized deductions, including non-reimbursed business expenses, student loan interest, retirement contributions, and medical costs that exceed a certain threshold. For instance, if you or a family member wound up with a very large medical bill, the IRS may let you deduct that from your taxable income.

To claim most deductions, you must itemize them on your tax return. However, doing so may not make sense if your itemized deductions don’t exceed the standard deduction.

What Is the Standard Deduction?

The standard deduction is an optional tax deduction that allows you to simplify your tax filing. Instead of itemizing, or listing out, individual tax deductions, you simply reduce your gross income by the amount of the standard deduction you qualify for.

The 2017 tax overhaul passed by Congress nearly doubled the standard deduction, causing far fewer people to file itemized returns. In 2020, the standard deduction is $12,400 for single filers who can’t be claimed as dependents on someone else’s tax return and $24,800 for married joint filers. In 2020, taxpayers 65 and older or those who are legally blind receive an additional deduction of $1,300 or $1,650, respectively.

It’s important to understand that if you claim the standard deduction, you can’t claim any other itemized deductions. Taking the standard deduction does not affect your ability to claim tax credits, however.

Taxpayers typically opt for the standard deduction when it is greater than the sum of the itemized deductions they could claim.

Other Common Tax Deductions

Home mortgage interest. You can deduct interest you pay on your home mortgage. The deduction is limited to interest on the first $750,000 of the mortgage if you’re married and filing jointly.

Student loan interest. You can deduct interest you paid on student loans taken out for yourself, your spouse or your dependent, up to a maximum of $2,500. This deduction also phases out for filers with higher incomes.

Charitable contributions. You can deduct the value of qualified contributions you make to charities.

State and local taxes. You can deduct any taxes you pay to your state or local municipality, up to $10,000 per year.

While both tax credits and tax deductions can reduce your tax burden, they do so in different ways. Credits directly affect the amount of tax you must pay, while deductions are subtracted from income before you figure the amount of tax you owe. You can also use credits and deductions together. With enough credits and deductions, you could even wind up owing nothing in federal taxes. You should be sure to speak with your Tax Advisor or Tax Preparer before taking any tax credits or tax deductions.

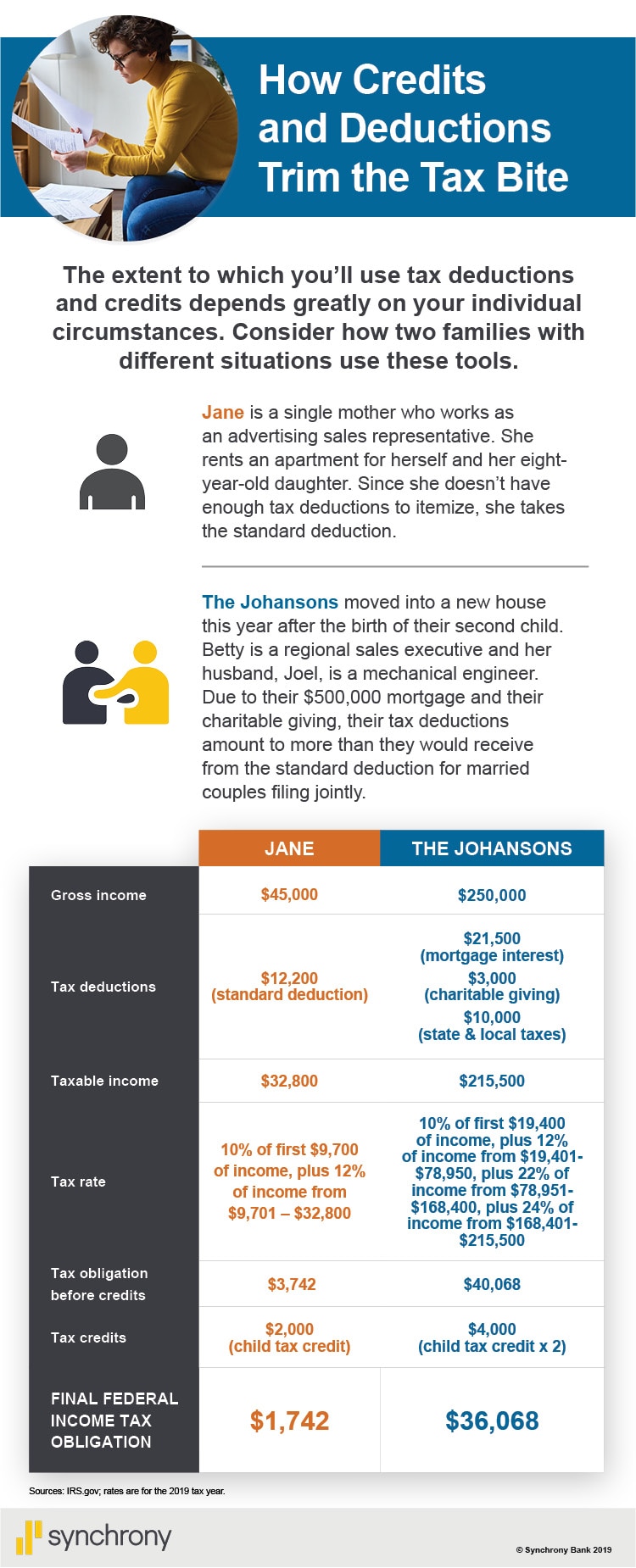

This chart is called How Credits and Deductions Trim the Tax Bite. The extent to which you’ll use tax deductions and credits depends greatly on your individual circumstances. Consider how two families with different situations use these tools. Jane is a single mother who works as an advertising sales representative. She rents an apartment for herself and her eight-year-old daughter. Since she doesn’t have enough tax deductions to itemize, she takes the standard deduction. The Johansons moved into a new house this year after the birth of their second child. Betty is a regional sales executive and her husband, Joel, is a mechanical engineer. Due to their $500,000 mortgage and their charitable giving, their tax deductions amount to more than they would receive from the standard deduction for married couples filing jointly.

Matt Kuhrt writes about finance and health care and lives on the Maine coast.

Read next: Tax Code Changes that Affect Your Savings Strategy.

This article is part of Synchrony Bank’s Personal Finance Series: Level 201. View all topics in the series here.