Wide-spread job loss, limited spending and a drop in income are all signs that the economy may be heading into a recessive climate. But what is a recession? And how can it affect your bank account and financial goals?

In a nutshell, a recession is a period of declining economic activity. As uncomfortable as they may be, recessions are a normal part of the economy. [1] While most recessions just last a few months, they are difficult to predict. Thankfully, there are some steps you can take to help strengthen your financial situation when the next recession hits.

What is a Recession?

A recession occurs when a country experiences a widespread and prolonged economic downturn that lasts for more than a few months. The U.S. Bureau of Economic Analysisdefines it as “a marked slippage in economic activity." [2]

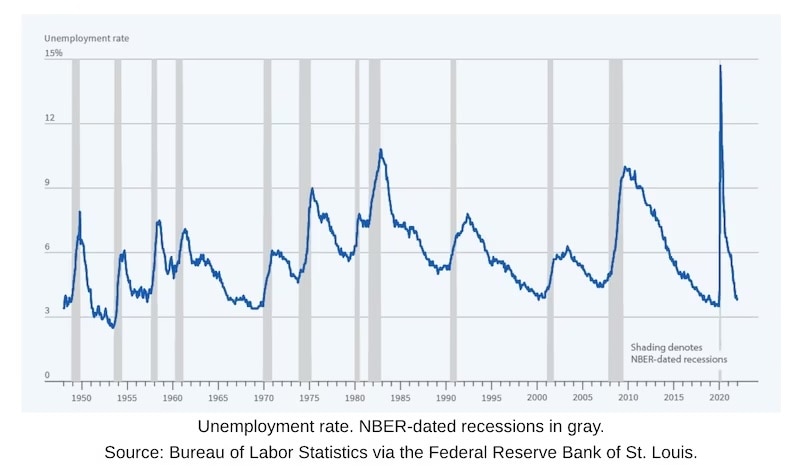

A recession is generally declared by the National Bureau of Economic Research (NBER), an independent body of experts who study how the economy works and track U.S. recessions. They look at different economic indicators to determine if the economy is experiencing a recession, such as a decline in GDP, real income, employment numbers, industrial production, manufacturing data and retail sales.

While recessions don't happen all the time, they are a normal part of the economic cycle.

What Happens During a Recession?

A recession can have a big impact on your finances. When a recession occurs, there are fewer opportunities, as companies cut jobs, consumers spend less, and wages remain low. [3]

A significant impact of a recession is job loss. As business activity slows, companies usually respond by cutting jobs and curbing expenses for things like advertising, training and other operations.

The increase in unemployment leads to consumers spending less. It can also impact the health care of workers, as many unemployed workers also lose their healthcare coverage. Recessions can also limit or decrease workers' retirement contributions and financial security.

However not all sectors are impacted negatively by recessions. There are some industries that are said to be recession-proof, as consumers still buy them even when money is tight. Household essentials like toilet paper and cleaning supplies are a good example of this. [4]

Common Causes of Economic Recessions

There are often a number of factors that happen that can cause a recession to occur, such as:

1. Asset Bubbles

When an asset costs more than it's worth but investors still flock to it, it's considered a bubble. Investors can become too emotionally invested in an asset, becoming overconfident in the market when things are good. But when the asset bubble pops, investors can "panic sell," which in turn can cause a recession. [5]

2. Too Much Inflation or Deflation

Inflation happens when prices rise over time and is part of any healthy economy. However, when prices increase quicker than expected, the economy can quickly get out of control.

The Federal Reserve counters inflation by raising interest rates, which in turn dampers economic activity and can cause a recession. Deflation is the opposite of inflation and causes prices to decline over time. This can cause wages to contract, with consumers spending less and triggering an economic decline. [6]

3. Sudden Economic Shock

When something suddenly happens that wasn't expected, it can cause a recession, such as a political event or sudden economic collapse. The COVID-19 global pandemic, which caused a recession, is a recent example of a sudden economic shock. [7]

4. Changes in Technology

While advances in technology are usually good over the long term, there can be short-term adjustments that can cause a recession as the economy adjusts. This happens as one industry or sector declines in favor of another. For example, historically during the Industrial Revolution, there were recessions as many professions were made obsolete. [8] Horse carriage makers, for instance, lost their jobs as more people started to use cars instead of horses as a mode of transport during the 1920s.[ As one industry becomes outdated, there can be a period between when workers lose their jobs and learn the skills needed for a new industry.

How Long Do Recessions Last?

Since 1945, recessions have lasted an average of 11 months, according to data from NBER. There have been four recessions in the U.S. in the last 30 years. [9]

The last one was the COVID-19 recession, which lasted only two months. It was the shortest recession in U.S. history. [10]

The Great Recession of December 2007 to June 2009 was caused by a bubble in the housing market. While it wasn't as long or severe as a depression, it did have severe effects on the economy. [11]

The Dot Com Recession of 2001 was caused by several factors, including a tech bubble crash, financial scandals at places like Enron, and the 9/11 terrorist attacks. [12]

The eight-month-long Gulf War Recession of the early 1990s was partly caused by a spike in oil prices from the First Gulf War. [13]

Recession vs. Depression: What's the Difference?

A recession and depression are similar but the main difference is that depressions last longer, there is more unemployment, and the economic decline is much worse than during an economic recession. It can also take longer to recover from a depression.

The last time the U.S. was in a depression was during the Great Depression, which began in 1929 and ended during World War II in 1941.[14] At its peak in 1933, unemployment rates reached almost 25% by some estimates.[15]

Tips to Prepare for a Recession

Recessions are impossible to predict but they are part of the economic cycle and bound to happen at some point. Here are some tips you can keep in mind to prepare your finances for a recession:

1. Increase Your Savings

When a recession hits, times can be tough for everyone. For many people that might mean having to dip into savings. Saving at least six months or more of living expenses in your emergency fund can help you prepare for tough times.

Saving can not only help buffer the effects of a recession, but with interest rates going up, savers stand to benefit from higher rates. For example, certificate of deposit (CD) rates tend to go up when the Federal Reserve increases interest rates. That means, with the right savings account, you can earn more money and increase your overall savings.

One savvy strategy is to park your money in a high-yield savings account or money market account. These accounts offer a higher interest rate than you would get with a regular savings account, helping you increase your emergency savings even more.

READ MORE: Just Started Saving? Here Are Next-Level Strategies

2. Prioritize Debt Repayment

With interest rates going up, it also means that lines of credit with variable interest rates could also increase—and so could your payment. If that happens, you'll end up paying more in interest overall. Now could be a good time to start making a plan to start aggressively paying off any variable interest debt.

And if you have high-interest debt, you may want to pay it off ASAP even if there's no recession, as credit card interest debt is never a good thing. And in a recession, unexpected job loss can make paying off your credit cards an impossible burden.

Plus paying off your debt can help lower your monthly expenses and the amount of interest that you pay on the outstanding balance. You could also take that extra money and funnel it into your savings or retirement account.

Reducing your debt can help improve your overall financial situation. Not sure where to start? Try these five tips to help reduce your debt.

READ MORE: Want to Be Debt-Free? Start with this Checklist

3. Spend Smarter

Rethink your approach to money and spending. Review your budget to see if there are ways that you can reduce how much you buy each month. If you were planning to buy a one-off expensive item, like a new car or TV, consider putting it off, shopping on sale, or buying used to save money. You can also consider using a cash back credit card like the Synchrony Premier World Mastercard to get cash back on all your essential purchases.

The Bottom Line

While no one likes recessions, they are bound to happen. With a bit of planning and saving, you can find ways to try to prepare your finances for a rainy day. Want to know more about what you can do to prepare for a recession and protect your savings? Read our Money Matters Blog.

READ MORE: How to Prepare Your Money for a Recession